April 2025

Normandin Beaudry Pension Plan Financial Position Index – Quebec Municipal and University Sector, March 31, 2025

Click here for our index which tracks the private sector.

Amid a period of stock market turbulence, the first quarter of 2025 ended with a slight deterioration in the financial position on the going concern and solvency basis.

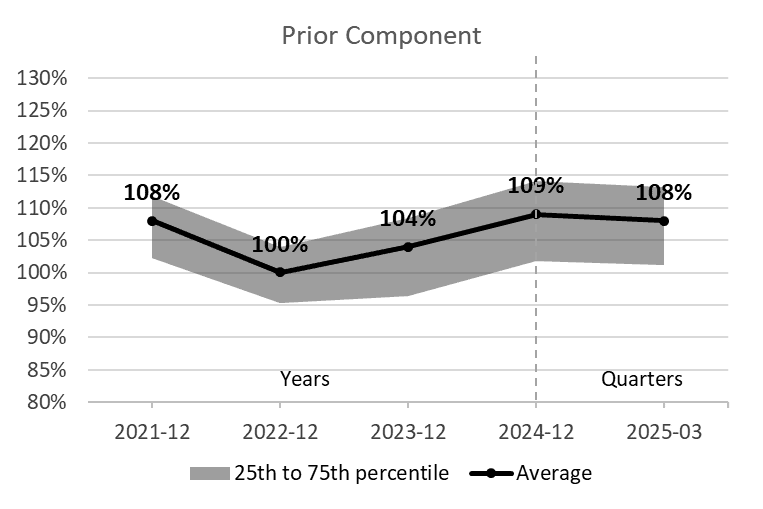

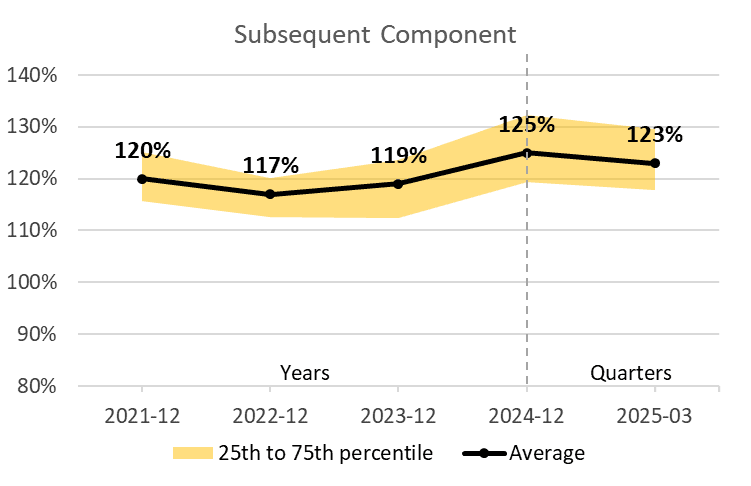

As at March 31, 2025, the average funded ratio of municipal and university sector pension plans is 108% for the prior component and 123% for the subsequent component (the components are distinguished by years of service accumulated before and after January 1, 2014 for the municipal sector and January 1, 2016 for the university sector). The ratios for the prior component and subsequent component were down 1% and 2%, respectively, in the first quarter.

Note: The illustrated going concern financial positions are adjusted to include the full market value of assets, and therefore include the reserve in the Previous component and the stabilization fund in the New component, excluding the effect of asset smoothing.

The deterioration in the financial position since the beginning of the year is due to the combined factors of investment performance and increased liabilities. Investment performance was slightly below return expectations, and discount rates decreased slightly.

Meanwhile, average current service costs inched up over the quarter.

The average solvency ratio for municipal and university sector pension plans as at March 31, 2025 stood at 99% for the prior component and 107% for the subsequent component. In the first quarter, the ratios for the prior component and subsequent component were down 1% and 2%, respectively.

The solvency financial position of pension plans deteriorated during the first quarter for the same reason as the going concern financial position, namely lower-than-expected returns and a slight decrease in discount rates.

Stock markets experienced significant volatility during the first quarter in reaction to the numerous executive orders and communications issued by the president of the United States since his inauguration on January 20, 2025. Consumers, businesses and governments around the world have been affected to varying degrees by the introduction of tariffs. In fact, the OECD has issued a downward revision of the 2025 economic growth outlook for many countries, including Canada and the United States. As no one is able to predict the impacts of such a trade dispute, uncertainty is at its peak.

Meanwhile, confidence among U.S. consumers and investors has fallen to a record low, even below the levels observed in 2020 during the pandemic. The risk of a recession and inflation are once again being closely monitored. In the first quarter, performance was particularly difficult for the U.S. stocks known as the “Magnificent Seven,” which are more exposed, on average, to risks of global growth slowdown than the rest of the market and which dragged down the returns of the S&P 500 and the MSCI World indices.

The Bank of Canada acknowledged that trade tensions with the United States could slow the pace of economic growth and increase inflationary pressures in Canada. Against this backdrop of economic uncertainty, the it cut its key interest rate twice during the first quarter of 2025, bringing it to 2.75%, in order to support economic growth in Canada. Although returns were generally positive in bond markets, short-term bonds posted a better performance.

The current geopolitical tensions and resulting volatility could have major repercussions in the short term. Fortunately, a number of pension funds established resilient strategies in advance, such as leveraging diversified portfolios, reducing the risks associated with the maturity of their plans, and incorporating margins for adverse deviations into their funding.

In this context, considering the healthy financial positions of most plans, it is essential to remain calm and adopt a long-term view when making investment decisions. The best practices in terms of governance and fiduciary responsibility in such a situation are to strictly adhere to the management framework, particularly by rebalancing assets when required according to predefined parameters and avoiding any emotional decisions based on short-term considerations.

That being said, certain strategies warrant closer attention in the current context. For example, risk related to currency fluctuation can be reevaluated by taking into account the current weakness of the Canadian dollar against foreign currencies, the concentration of exposure to certain currencies, and the current cost of hedging, which has recently increased.

- Average funded ratio:

- Prior component: 108% as at March 31, 2025, down 1% year-to-date

- Subsequent component: 123% as at March 31, 2025, down 2% year-to-date

- Average solvency ratio:

- Prior component: 99% as at March 31, 2025, down 1% year-to-date

- Subsequent component: 107% as at March 31, 2025, down 2% year-to-date

- Positive returns in bond markets and negative returns in global equity markets over the first quarter

- Slightly lower discount rates in the first quarter, increasing liabilities and current service costs.

Are you wondering whether your plan’s portfolio is well diversified or whether the risks your fund is exposed to are being managed adequately? Contact your Normandin Beaudry consultant or email us.

The Normandin Beaudry Pension Plan Financial Position Index is calculated by projecting the pension plan financial data of its clients in the Quebec municipal and university sector. A separate index is published for the plans of Canadian clients outside of this sector. Assets are projected based on the performance of market indices. Liabilities projected on a going concern basis use an estimated discount rate based on each plan’s asset allocation and the sensitivity of asset classes to changes in interest rates on Government of Canada bonds. The discount rates used on a solvency basis are those prescribed by the Canadian Institute of Actuaries, and those for transfer values are therefore based on the previous month’s market interest rates.