April 2024

Normandin Beaudry Pension Plan Financial Position Index – Quebec Municipal and University Sector, March 31, 2024

Click here for our index which tracks the private sector.

The year 2024 is off to a positive start for pension plans, with favourable stock market returns and rising interest rates, which tend to reduce the value of pension plan liabilities.

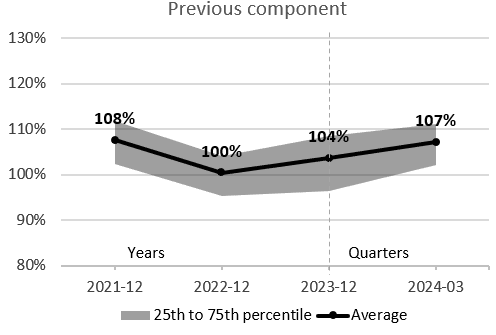

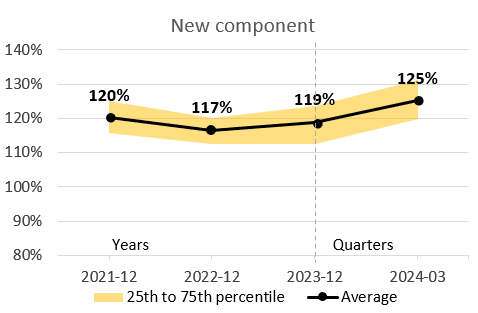

As at March 31, 2024, the average funded ratio of municipal and university sector pension plans is 107% for the Previous component and 125% for the New component (the components distinguish between years of service accumulated before and after January 1, 2014, for the municipal sector and January 1, 2016, for the university sector). In the first quarter, the ratio is up 3% for the Previous component and up 6% for the New component.

Note: The illustrated funded ratios on a going concern basis are adjusted to include the full market value of the assets, and therefore include the reserve in the Previous component and the stabilization fund in the New component.

The financial position of pension plans improved markedly during the first quarter of the year, thanks to favourable market conditions. The first quarter of 2024 generated strong returns, driving up plan assets, while rising interest rates lowered actuarial liabilities. Additionally, long-term return expectations for various asset classes have been revised upwards, resulting in higher discount rates as at December 31, 2023, which partly explains the improved financial position reflected in the index as at March 31, 2024.

The rise in discount rates also had a downward effect on current service costs over the quarter.

The average solvency ratio for municipal and university sector pension plans as at March 31, 2024, is 102% for the Previous component and 112% for the New component. In the first quarter, the ratio is up 2% for the Previous component and up 1% for the New component.

Favourable returns and rising interest rates both contributed to this improvement.

The main stock market indices delivered strongly positive returns in the first quarter of 2024. In fact, nearly three quarters of S&P 500 companies reported higher earnings in their year-end 2023 results than those anticipated by financial analysts. Stock market optimism was felt more strongly in growth-style strategies, which continued their outperformance of late 2023. The U.S. market, driven by tech and AI stocks, continues to dominate the major stock markets, with a return of 13.5% when translated into Canadian dollars.

Bond market returns were negative, but less so than stock market gains. Corporate bonds (having benefitted from narrowing credit spreads) and shorter-maturity bonds (which are less sensitive to interest rate movements) mitigated bond market losses. With the economy proving resilient and inflationary pressures persisting, investors are expecting fewer key rate cuts for 2024 than forecasted at the start of the year. This pushed up bond market interest rates and explains the negative yields.

With pension plans currently in favourable financial positions, many administrators are taking this opportunity to deploy risk management strategies, including the use of various margins in the discount rate assumption. The use of margins is an interesting strategy since it limits the risk of increased contributions in the event that:

- interest rates and future returns expectations fall; or

- the plan matures because of an increase in the retirees’ portion of total liabilities or an increase in the members’ average age.

The use of a margin for adverse deviations also provides a financial buffer by improving the likelihood of preserving the plan’s financial health in the event of future uncertainties, such as economic growth weaker than what is anticipated in the long-term assumptions.

Finally, the use of various margins should be aligned with the funding policy.

- Average funded ratio:

- Previous component: 107% as at March 31, 2024 / up 3% over the first quarter

- New component: 125% as at March 31, 2024 / up 6% over the first quarter

- Average solvency ratio:

- Previous component: 102% as at March 31, 2024 / up 2% over the first quarter

- New component: 112% as at March 31, 2024 / up 1% over the first quarter

- Strongly positive returns over the quarter in stock markets and negative, but less pronounced, returns in bond markets

- Going concern and solvency discount rates rose in the first quarter, resulting in a decrease in liabilities and current service costs

If you have any questions, contact your Normandin Beaudry consultant or email us.

The Normandin Beaudry Pension Plan Financial Position Index is calculated by projecting the pension plan financial data of its clients in the Quebec municipal and university sector. A separate index is published for the plans of Canadian clients outside of this sector. Assets are projected based on the performance of market indices. Liabilities projected on a going concern basis use an estimated discount rate based on each plan’s asset allocation and the sensitivity of asset classes to changes in interest rates on Government of Canada bonds. The discount rates on a solvency basis are those prescribed by the Canadian Institute of Actuaries, and those for transfer values are therefore based on the previous month’s market interest rates.