January 2025

Normandin Beaudry Pension Plan Financial Position Index – Quebec Municipal and University Sector, December 31, 2024

Click here for our index which tracks the private sector.

The going concern financial position improved during 2024 but remained stable in the fourth quarter. Meanwhile, the solvency financial position remained stable throughout 2024 and in the last quarter.

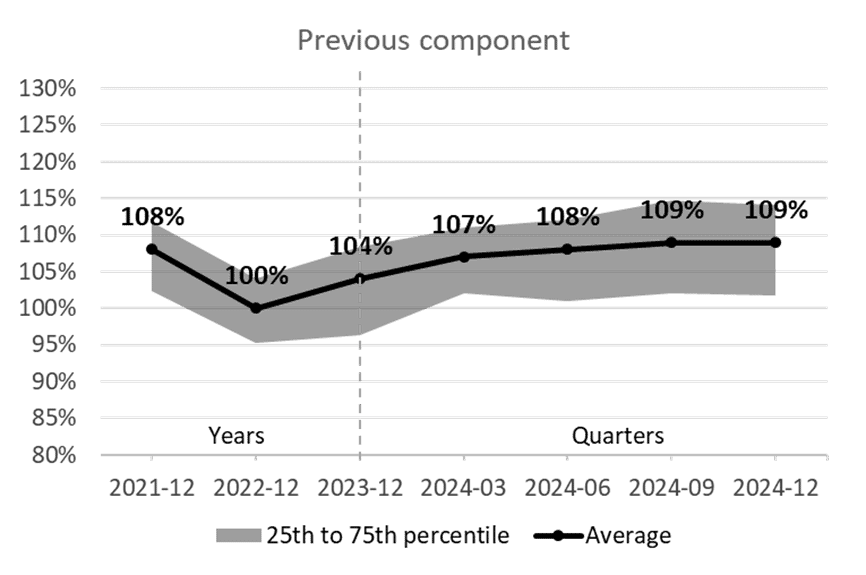

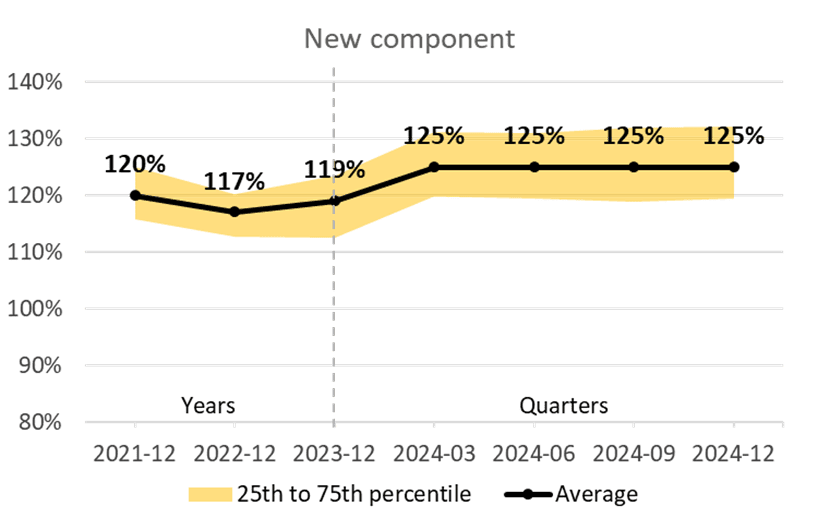

As at December 31, 2024, the average funded ratio of municipal and university sector pension plans is 109% for the Previous component and 125% for the New component (the components are distinguished by years of service accumulated before and after January 1, 2014, for the municipal sector and January 1, 2016, for the university sector). The ratios for the Previous component and the New component remained stable in the fourth quarter and are up 5% and 6%, respectively, since the beginning of the year.

Note: The illustrated going concern financial positions are adjusted to include the full market value of assets, and therefore include the reserve in the Previous component and the stabilization fund in the New component, excluding the effect of asset smoothing.

During the fourth quarter, investment performance was in line with return expectations, and there was little change in pension plan liabilities, with discount rates remaining similar to those of the last quarter. The improvement in the financial position since the beginning of the year is primarily explained by investment performance.

Average current service costs also remained stable in Q42024 and are similar to the levels seen at the beginning of the year.

The average solvency ratio for municipal and university sector pension plans as at December 31, 2024, is 100% for the Previous component and 109% for the New component. The ratio for the Previous component is down 2% in the fourth quarter, bringing it to the same level as the beginning of the year. The ratio for the New component remained stable in the fourth quarter and is down 2% since the beginning of the year.

The solvency financial position of pension plans remained stable during the fourth quarter due to investment performance being in line with return expectations and there being little change in actuarial liabilities due to variations in discount rates.

The year 2024 was shaped by the widespread fight against inflation and central bank interventions to restore order. In addition, the world went through a period of intense political activity, with elections in over fifty countries, including an election in the United States that garnered global attention and could have a major influence on the years to come. Furthermore, geopolitical tensions are escalating around the world, including threats of tariff increases, challenges to international collaboration on global issues such as climate change and, more directly, continued armed conflicts.

Against this tumultuous backdrop, stock markets nevertheless delivered remarkable returns, with the MSCI World Index even exceeding 20%, in Canadian dollars, for a second year in a row. The depreciation of the Canadian dollar since the US elections has had a positive impact on Canadian pension funds’ foreign market investments. A more significant part of this remarkable performance is attributable to the general optimism among investors, particularly directed at tech giants positioning themselves at the forefront of advances in artificial intelligence. However, this dynamic does not come without risks: the main stock indices, which are showing record levels of concentration, are more vulnerable to a potential market adjustment. Furthermore, the rising price-to-earnings ratios for these companies imply that their valuations depend on sustained growth in their profits.

With regard to bond markets, central banks have continued to cut key interest rates in response to stabilizing inflation and the economic slowdown. In particular, the Bank of Canada cut its key interest rate by 1.0% in the fourth quarter to stand at 3.25% at the end of 2024. However, interest rates on long-term bonds remained relatively stable, resulting in a return to a slightly upwards sloping interest rate curve.

Direct real estate valuations have experienced corrections over the last two years, but more recent months suggest a return to performance that aligns with expectations for the sector.

The bull markets over the last years contributed favourably to today’s pension plan financial positions. A number of plans are now showing surpluses on both a going concern and solvency basis.

This opens the door to essential strategic thinking to help preserve the sound financial health of plans over the long term, whether by adopting new measures or by revising existing approaches. In some cases, surpluses are reaching a level that makes them available for use—a situation that has not occurred since the late 90s.

It is crucial that strategic thinking be based on accurate, up-to-date data. As a result, even though a complete actuarial valuation is not required for certain plans as at December 31, 2024, several organizations are considering having one prepared anyways due to the current context. Doing so will provide an accurate representation of the plan’s demographic evolution, among other things, and make it possible to adjust actuarial assumptions according to the latest economic and demographic trends.

An alternative to a complete actuarial valuation would be to obtain a financial situation forecast as at December 31, 2024. Although less exhaustive, such a forecast still provides useful input for strategic thinking. Both options constitute powerful tools for governance and risk management that make it possible to fulfill a number of fiduciary duties in the context of risk management described in the new Guideline No. 10 released by the Canadian Association of Pension Supervisory Authorities (CAPSA) last September.

- Average funded ratio:

- Previous component: 109% as at December 31, 2024 / no change over the last quarter and up 5% year-to-date

- New component: 125% as at December 31, 2024 / no change over the last quarter and up 6% year-to-date

- Average solvency ratio:

- Previous component: 100% as at December 31, 2024 / down 2% over the last quarter and no change since the beginning of the year

- New component: 109% as at December 31, 2024 / no change over the last quarter and down 2% year-to-date

- Returns are similar to expected returns based on discount rates in the last quarter but are higher than those since the beginning of the year

- Discount rates are similar to those of the previous quarter and beginning of the year, resulting in little change in liabilities and current service costs

Wondering whether you should have a complete actuarial valuation or financial situation forecast prepared for your plan as at December 31, 2024? Contact your Normandin Beaudry consultant or email us.

The Normandin Beaudry Pension Plan Financial Position Index is calculated by projecting the pension plan financial data of its clients in the Quebec municipal and university sector. A separate index is published for the plans of Canadian clients outside of this sector. Assets are projected based on the performance of market indices. Liabilities projected on a going concern basis use an estimated discount rate based on each plan’s asset allocation and the sensitivity of asset classes to changes in interest rates on Government of Canada bonds. The discount rates used on a solvency basis are those prescribed by the Canadian Institute of Actuaries, and those for transfer values are therefore based on the previous month’s market interest rates.