July 2023

Normandin Beaudry Pension Plan Financial Position Index, June 30, 2023

Follow this link to consult our index that tracks the Quebec municipal and university sector.

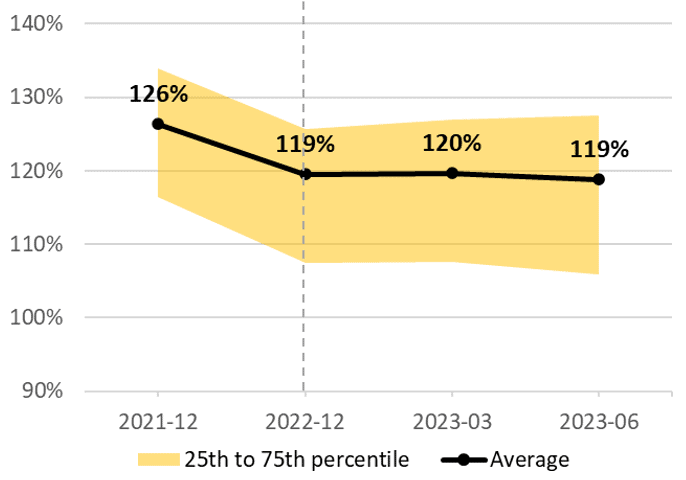

The average pension plan funded ratio changed little in Q2 2023 and year-to-date.

The average pension plan funded ratio, excluding the effect of asset smoothing, is 119% as at June 30, 2023, down 1% over the second quarter and at the same position as at the beginning of the year.

Note: The illustrated funded ratio excludes the effect of asset smoothing. A plan that uses this mechanism can therefore expect a less significant change in its financial position.

The financial position was little changed in Q2 2023, as investment performance was similar to expected returns and there was no significant change in the discount rates used to value pension plan liabilities.

There was also little change in current service costs in Q2 2023 for the same reason.

The average pension plan solvency ratio as at June 30, 2023 is 110%, down 1% over the second quarter, but up 3% since the beginning of the year.

The slight decline in the solvency financial position in Q2 2023 stems primarily from higher pension plan liabilities. Despite the slight increase in interest rates in Q2 2023, some discount rates prescribed by the Canadian Institute of Actuaries (CIA) have decreased slightly.

The average pension fund generated slightly positive returns in Q2 2023 and more significant returns since the beginning of the year.

In equity markets, exposure to U.S. equities, especially the technology sector, has been particularly favourable. While the majority of sectors have posted negative or modest returns since the beginning of the year, the seven largest U.S. companies (Apple, Microsoft, Amazon, Nvidia, Alphabet/Google, Tesla and Meta) have generated a return of around 40% since the beginning of the year. Their securities alone explain the overall performance of the U.S. market. The race to develop artificial intelligence is undoubtedly a factor of enthusiasm for this sector.

As for fixed income securities, returns were generally negative during the quarter. The job market turned out to be more resilient than initially anticipated, putting upward pressure on interest rates, especially for bonds with shorter maturities. Credit spreads, which correspond to the additional interest rates offered by the corporate sector relative to federal bond rates, are lower than during the Silicon Valley Bank failure. However, they remain at higher levels than historical averages.

Although some organizations feared having missed the opportunity to buy insured annuities at high implied yields at the beginning of the year, this opportunity is back with the most recent rise in interest rates. Other risk reduction strategies may also be appealing for the same reason.

- Average funded ratio: 119% as at June 30, 2023 / down 1% over the quarter and no change since the beginning of the year

- Average solvency ratio: 110% as at June 30, 2023 / down 1% over the quarter, but up 3% since the beginning of the year

- Positive equity market returns over the quarter, in particular due to the performance of large U.S. technology companies, and negative returns from fixed income securities

- Little change in discount rates on a going concern basis, so little change in the value of liabilities and current service costs on this basis

- Slight decrease in discount rates on a solvency basis explains the slight pullback in the financial position on this basis

If you have any questions, contact your Normandin Beaudry consultant or email us.

The Normandin Beaudry Pension Plan Financial Position Index is calculated by projecting the pension plan financial data of its Canadian clients, excluding plans in the Quebec municipal and university sector. A separate index is published for these pension plans. Assets are projected based on the performance of market indices. Liabilities projected on a going concern basis use an estimated discount rate based on each plan’s asset allocation and the sensitivity of asset classes to changes in interest rates on Government of Canada bonds.